A brilliant financial adviser with equally brilliant financial advice can make a huge difference to a client’s life.

We understand this at Inspired Money, which is why we make it our mission to inspire clients like you to take the neccessay actions to achieve the life goals you are wanting to achieve.

Our clients are happy with our services, but most don’t know what goes on behind the scenes, or see all the work we put in to provide the advice our clients value & need to achieve and succeed.

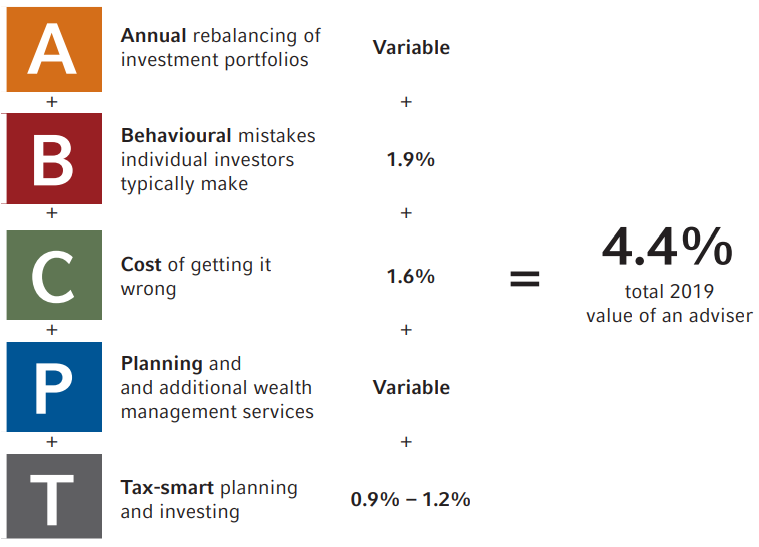

It’s with this in mind that we’re writing this blog and sharing some insight from a 2019 study by Russell Investments, on the value of an adviser. This study captured the true value of a financial adviser and the value we deliver our clients throughout their financial advice journey.

So, what is the true value of a financial adviser? Read on to find out.

A: Annual rebalancing

Annual rebalancing is important and something that can be easily underestimated.

A good financial adviser, has a deep understanding of a client’s goals and tolerance to risk, which enables them to know when and how a rebalancing should occur.

The cost of getting this wrong or not taking this into consideration is variable in nature.

B: Behavioural mistakes

In a world of investing, filled with risks, uncertainty and market volatility, it’s only natural for clients to react in fear and perhaps even want to pull their investments altogether. In fact, the study of investor behaviour demonstrates that many investors buy high and sell low.

The value of a financial adviser is prevalent here, with the ability to guide clients in a direction best for their long-term objectives, rather than the short-term ones.

The report believes this adds as much as 1.9% p.a. of additional return to an investor’s portfolio.

C: Cost of getting is wrong

Investing without professional advice from a financial adviser can be dangerous. Research from Deloitte shows that investors often experience a disconnect between their risk profiles and their return expectations.

A financial adviser can effectively remove this disconnect, by helping determine the best possible investment strategy and risk profile, with less likelihood of getting it wrong.

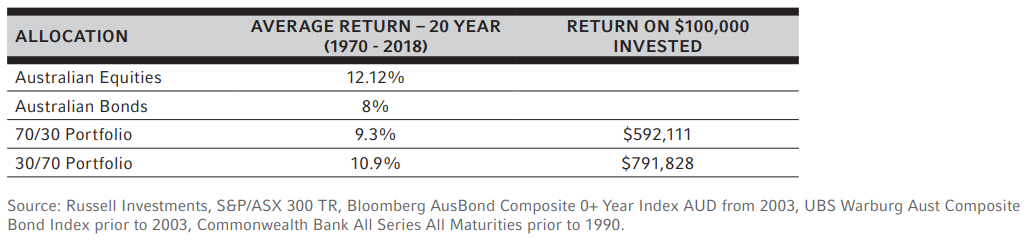

In the below example, givein to us in the report, we look at average returns of Australian equity and bond portfolios over a 20-year period. If an investor held 70% of their portfolio in growth assets and 30% in defensive, their average annual return would be 10.9% over the 20-year period. If, however, they held just 30% growth assets and 70% defensive, they would achieve annualised returns of 9.3%.

In this case, if a younger investor had invested conservatively instead of in the growth option, they would have missed out on an average of 1.6% return every year for 20 years. On $100,000 invested, that’s a significant difference of almost $200,000 to the final return.

P: Planning

We all know that planning is paramount in life, money and business, and financial advice is no exception.

Financial advisers include planning in their valuable advice in the form of:

- Statements of Advice

- Customised Financial Plans

- Annual Portfolio Reviews

- Investment and Income Planning

- Retirement Planning

- Cashflow analysis and budgeting

Planning helps ensure your financial adviser gets you where you want to go.

As Russell’s report states the quantification of the value of planning is variable depending on the adviser’s practice and services offered.

T: Tax-smart investing

Although financial advisers are just that, financial advisers, and not accountants, they provide value in the tax knowledge they do have when investing is concerned.

Tax-smart financial advisers can add value by:

- Considering tax-minimising investment solutions

- Working alongside tax and legal advisers

- Assisting with salary sacrifice arrangements

- Managing potential ‘tax surprises’ as regulatory changes occur

The value of an adviser for tax-smart investing is at least the sum of:

- tax effective investment strategies

- salary sacrifice pre- and post- superannuation contributions (depending on account

balances)

Taking the above considerations, we estimate this to be between 0.9%-1.2%pa, depending on whether the client is in an accumulation or transition to retirement phase, based on average balances.

These are just some of the many ways we, and other high-quality financial advisers are truly valuable.

The bottom line

The value of an adviser is meant to quantify the contribution that the technical and emotional guidance a trusted human adviser, delivering services and value above and beyond investment-only advice, can potentially offer.

4.4% or more

This value is a meaningful differentiator in a time of regulatory scrutiny and the challenging

market environment.

Remember, an adviser’s clients are their most persuasive advocates, so helping them to understand the value you deliver is essential. This formula offers a memorable and repeatable framework for advisers to have that conversation with confidence:

At Inspired Money, we provide you with a fully transparent, accountable and affordable Perth financial planning option. If you’d like to see some value for yourself, contact us in our Perth office today or visit our website to find out how we can help you on your financial advice journey.

Until then, you can find more information, research and statistics in the full Russell Investments study ‘2019 Value of an Adviser Report’.