A large part of wealth creation for the average mum and dad is built upon the setting of several large goals and then breaking them down into smaller actionable tasks that become habits over time.

For these actions to become habitual we need to be able to attach a strong emotional attachment to what the success around the attainment of that goal feels like.

Whilst this isn’t limited to wealth creation alone, the missing link for many people in actually achieving their financial goals is the lack of an action plan that articulates the small steps needed to be taken on a regular basis and an accountability mechanism to keep everything on track.

As I have seen in my mission to get healthier over the past couple of years, understanding my own weaknesses in sticking to an activity program (gym membership) and a nutrition plan has allowed me to look for ways to not allow myself to fail. Knowing that if I let myself not get up early and go to the gym often results in me allowing myself to also not go in the afternoon or evening as I allowed other areas of my life to get in the way. Powered with this understanding of my behaviours, I needed to be held accountable by someone or something else. I now attend a gym nearby at 6 am, three to four mornings a week where I need to book my sessions on an app to ensure I can get into this popular group fitness class. By 6.45 am my fitness goal for the day is done.

Financially, it’s not much different. Setting a goal recently I was strongly attached to emotionally, I caught myself on multiple occasions being tempted by other opportunities to make purchases that whilst they would have been fun and maybe needed (but not yet), I stopped myself from making such purchases as every time I was tempted to buy I remembered that those funds were needed to help me achieve the bigger more important goal that I was saving for that only a couple of months later was attained.

The evolution of Goal setting

An article I recently read from Berkeley Well-Being Institute was about setting the right goals in the right ways so that you can easily reach your goals. Setting goals helps us gain the clarity we need to take the actions that get us to where we want to go.

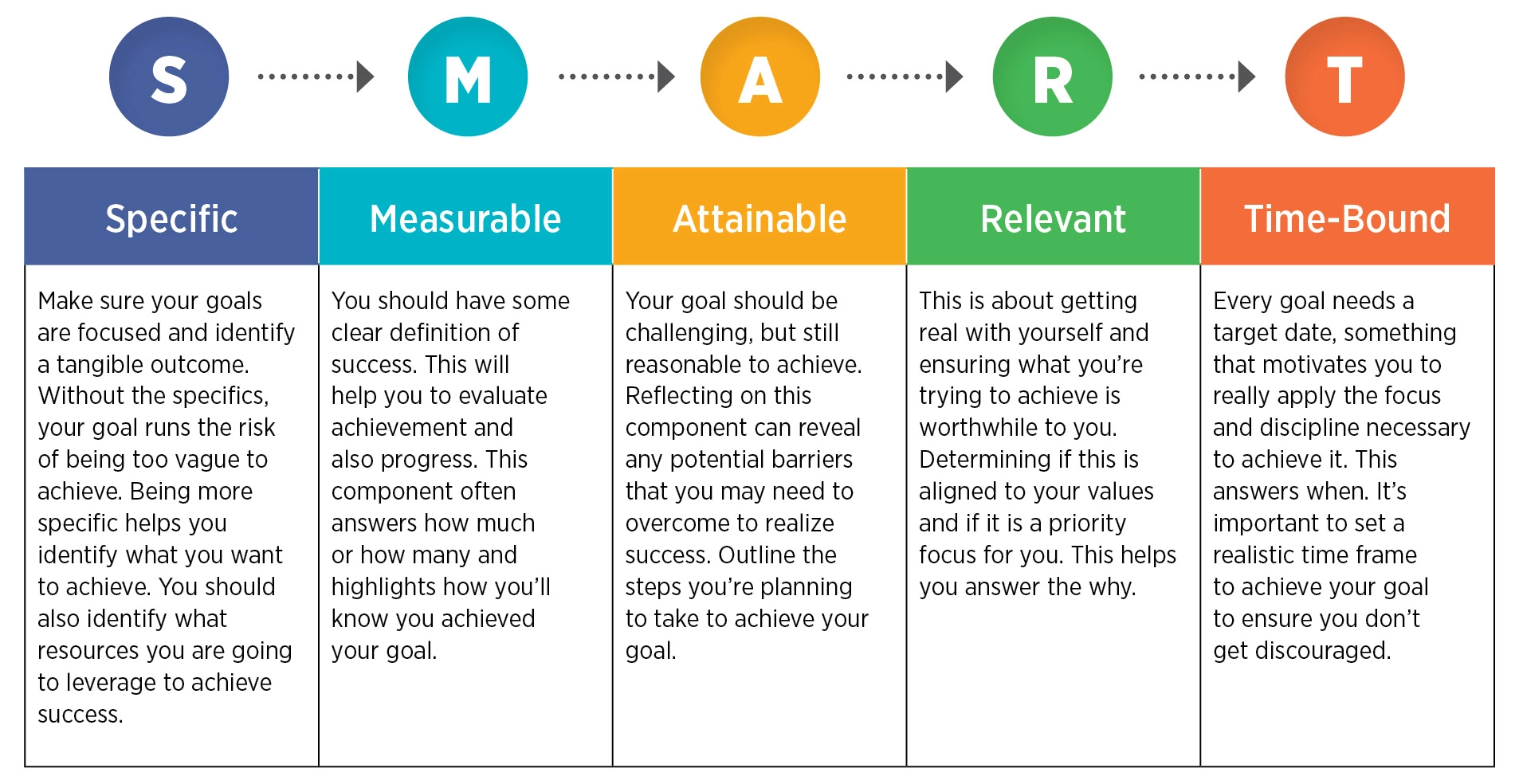

As goal setting has evolved over time as we understand what works and what doesn’t, we’ve come a long way from New Year’s Resolutions as our defining goals, the modern theory now focuses on the SMART goal methodology:

Using this method we set less wishy-washy goals, but one of the most important attributes in achieving a goal that has been set is found in the alignment of the goal to the life we want to live rather than the one we don’t.

Quite often I hear people tell me they want to be comfortable in retirement as one of their goals. Whilst it’s a nice feeling, being comfortable, it sort of lacks a key element of specificity of what is comfortable for them. So, we must drill down further as to their ideal vision of what comfortable means and would it be sustainable. How would we measure their level of comfortableness so that we know it could be achieved?

In the timeframe this individual has until their retirement, is the outcome achievable and how would we track their progress towards this goal?

Assuming this retirement goal was defined further so that we had a timeframe, an amount of income per annum with which the above individual felt was a comfortable amount of money to receive each year that allowed them to live a life of comfort, the resources required to achieve the goal were available and it was a realistic financial target to aim for and we could track it, doesn’t mean it is still the right goal for that individual. What if six months down the track into this comfortable retirement, the person who set this goal realises that this is not the life they want but now no longer have the resources available to achieve the new improved goal?

One of the biggest challenges we face with setting goals that are life-changing is to be emotionally invested in the outcome of the goal in a way that enhances our life.

The action plan needed to achieve the goal is where the rubber hits the road and it’s usually at this point that the goal is achievable or doomed.

Small actions that are not compromised by other conflicting priorities work best. They are repeatable and have nothing getting in their way, that is, they aren’t competing for attention from other goals, such as allocating financial resources to achieve one bigger short-term goal (maybe paying off a credit card) instead of allocating savings to retirement funding or a mortgage reduction goal.

Not all goals are the same, but they do require a similar process and daily motivation and a daily focus to increase the likelihood of their achievement.

Prioritising of goals

It’s not uncommon at any one point in time we have multiple goals on the go at the same time. Thus, it’s important that we actually spend some time going through the goal-setting process carefully and often, to list down which goals are more important than the others.

You’ll need to understand which goals will take more of the resources than others to achieve and balance these with the responsibilities and commitments you already have in life and determine if right now, the actions needed to achieve this are possible.

Check-in with yourself often to ensure you are still as emotionally invested in the outcome of the goals you are working on as you were when you set them. If not, tweak your goals so that you have your new list of prioritised goals, reallocate resources, and assess timeframes and action plans.

Educate yourself on the areas your goals apply to

As with my health journey that I mentioned earlier, just doing something doesn’t mean you will be successful. You will often need to boost your understanding of some of the key areas you need to take action.

If your goal is health-related, obtaining a better understanding of nutrition and applying that new knowledge increases your chances for success in bettering your health over time.

If your goal is financial, its likely you will need to improve your understating of compound interest, asset allocation and some other key financial terms and concepts which can allow you to make better big picture decisions so that the key parts you need to focus on are the action steps each day, week, month to put your plan into action.

Automate where possible

Quite often the action steps for many financial goals can be automated allowing your focus to be on the achievement of other goals that require more of your time and headspace.

Where automation is not possible, it’s just as easy to take one tiny step to trigger the next bigger action. This can be as simple as getting your gym clothes and shoes ready the night before, so you have one less obstacle in the way, or meal prepping on the weekend to keep your nutrition plan on course. Financially, as mentioned above it’s possible to automate certain actions such as contributing more to your retirement savings goal and establishing direct debits to your utility providers to reduce bill shock.

There are reasons why we set goals, quite often, it’s because we want to achieve more than what we are currently achieving. The habits and behaviours we applied to place ourselves in these situations, won’t help us to achieve the outcomes we want for ourselves in the future. Not all of our goals will be achievable in the short term, so we should not beat ourselves up if it doesn’t appear that we are achieving our goals straight away. There is usually an element of undoing that needs to happen before we start to see the results.

Written by Director & Senior Adviser Shane Mitchell.

To book a session to review your goals contact Shane directly on 08 6222 7909 or book a meeting directly via his booking page.