Here are our best 3 tips on how to avoid not paying top dollar for your life cover

Changes to how we shop for life insurance

In days gone by, life insurance was sold by door-to-door salesmen usually aligned to one specific insurance company. Now we have life companies going direct to consumers via a plethora of channels from cover under Credit card, online via their own websites, at the supermarket checkout and the traditional channel of a financial adviser. Whilst the life insurance market in Australia is not as developed as say the US or UK markets there are several ways that you can end up overpaying for your insurance. Taking the default cover through our super may see us pay more, one prominent industry fund charges the same rate for individuals who are 16 as they do for those aged 50. Great for the 50yo who has had a chance to build up their super assets to absorb some of the premiums, but not so great for the youngster who is effectively subsidising those in their late 40s and early 50s in that fund.

It’s accepted that where you don’t have to answer a multitude of medical questions on your own situation, you will end up overpaying for your insurance.

How we own our cover can have a significant impact on the after-tax cost of that premium.

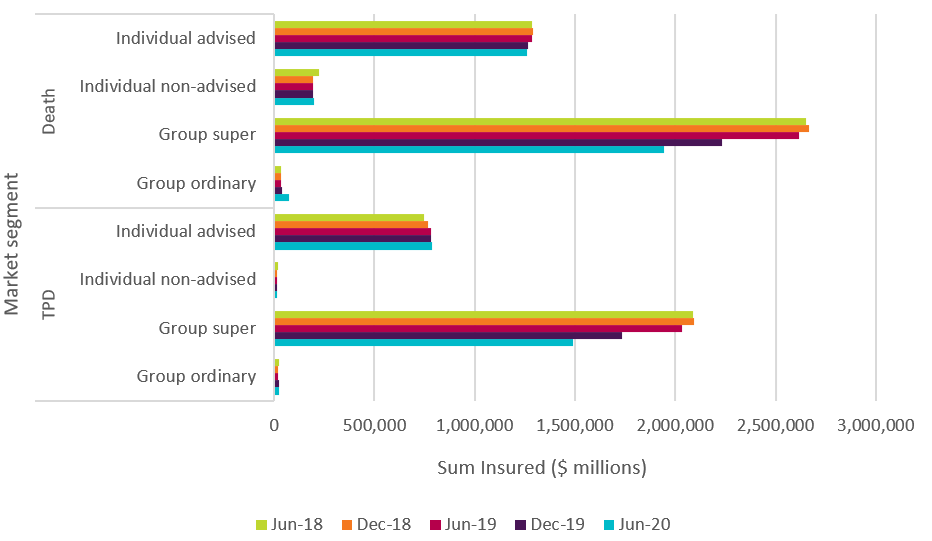

Since the mid 90’s it has been possible for Aussies to own life and disability cover via their superannuation funds. Great idea, but it’s quite easy to see this method spiral out of control as we often don’t place the same value on the money in our super account as we do the savings in our bank account. Left unchecked, the amount of cover in our super funds normally increases with inflation which also sees premiums head upwards each year. This puts us at risk of being overinsured and paying more for the cover we have and don’t need.

Where we have income protection insurance/ salary continuance cover paid by our super funds, our fund gets the standard super fund tax deduction of 15% of the premiums paid. A useful strategy where cashflow is tight but not the greatest from a taxation viewpoint, usually resulting in us paying more as the tax rates we pay personally for being higher than what the super fund tax rate is. This means we are giving up a bigger tax deduction for the same premium being paid to the insurer.

Not reviewing our cover when our situation changes.

Insurance can be seen as a policy that is the bridge between our human capital (the time and dollars we will earn in the future) and the financial capital we currently have working for us.

So when we have a change of situation, a decrease in debt, the accrual of multiple years of sick leave and even long service leave as well as the increase in our emergency cash reserves, all are great reasons to seriously look at what personal insurances we have, do we have the right mix in place for our current and future needs, can we start making trade-offs that will see us balance that human and financial capital gap as we balance out our financial plan