One of the most frequently asked question I’ve been asked over my 20+ years of broking is “Which is better for me, fixed or variable?”

The truth is the answer is, that depends on your personal situation.

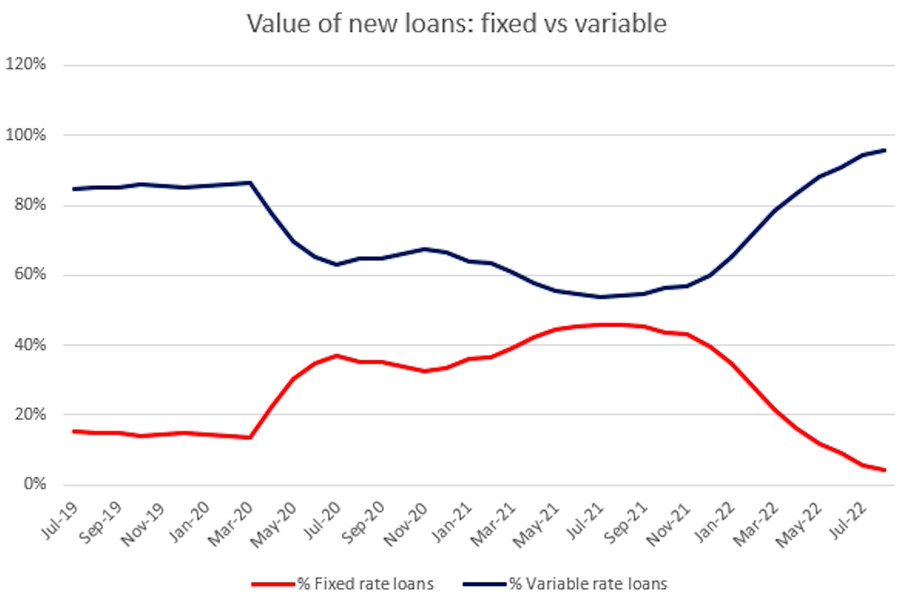

With variable-rate loans dominate the market, accounting for about 96% by value, or the highest proportion versus fixed-rate loans since late 2008. (Source: @RateCity, ABS) here are the pros and cons of each:

Variable Interest Rates: A variable home loan can provide borrowers with more flexibility in paying off their loan, but comes with the risk of the interest rate fluctuating during the loan period.

This risk is front of mind now that the RBA has again increased the cash rate target which will be passed on by most if not all lenders, and will see your repayments increase again.

But the benefits of choosing a variable rate include:

- The flexibility of additional payments with no penalties for early payout,

- The possible option to have an offset account that could help you reduce the amount of interest you pay,

- Comes with features that can adjust to your current financial situation (such as redrawing, pricing reviews, or substitution of security).

Both options should be considered carefully in making your decision.

If you would like further assistance in understanding which option best suits you please reach out to me or one of the Inspired Money Team on 08 6222 7909 or via email at admin@inspiredmoney.com.au.

This article was written by Darrel Roberts, Head of Mortgage Lending Services at Inspired Money with over 30 years of experience in mortgage lending and accounting he is an expert in his field.