I’ve got some crucial insights to share about the ever-contentious topic of housing affordability. A recent study by the Reserve Bank of Australia has shed some light on this debate, and the findings are too important to ignore1.

The Good Ol’ Days?

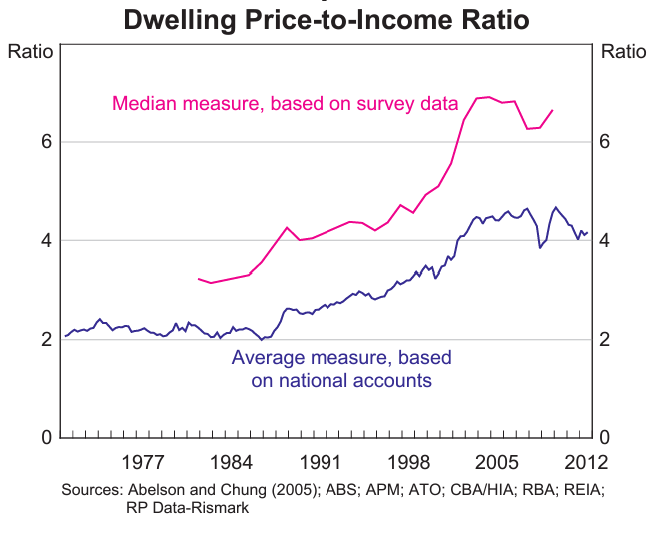

Let’s take a trip down memory lane to the 1980s…and what a time that was! Back then, it took an average household just two years of moderate savings to afford a down payment on a home. Fast forward to 2023, and you’re looking at a whopping five and a half years of saving for that same down payment1.

The Financial Burden Now

Today, mortgage repayments consume about a third of a household’s income, compared to only a fifth in the ’80s1. And if you think interest rates are your friend, think again. They’ve risen faster in the past year than they have since the mid-’80s1.

Location, Location, Location

Where you choose to live also plays a massive role in your buying power. New South Wales, Tasmania, and Victoria have the highest buy-in prices, making it even tougher to break into the market1.

Actions to Limit Impact

So, what can you do to navigate this challenging landscape?

- Consult a Mortgage Broker: A broker can help you find the best mortgage rates and guide you through the application process.

- Explore Government Incentives: Programs like the First Home Loan Deposit Scheme can offer some financial relief1.

- Consider Building: Sometimes, building a home from scratch can be more cost-effective than buying an existing one.

- Strategic Saving: Given the longer time needed to save for a down payment, consider high-interest savings accounts or investment options to accelerate your savings.

- Stay Informed: Keep an eye on interest rates and market trends. Knowledge is power, especially in a volatile market.

My Final Thoughts

The housing market is tough, but it’s not insurmountable. With the right strategy and guidance, you can still find your way to homeownership. If you’re serious about this, let’s talk and make a plan that works for you.

Feel free to reach out to me or one of the Inspired Money Team for personalised advice tailored to your situation. Let’s make your homeownership dream a reality!

This article was written by Nicole Monks, Mortgage Consultant with Inspired Money, and provides general information that should not be considered personalised financial advice. If you have specific questions or concerns book a session to review your current mortgage situation or any other lending issue contact Nicole directly on 08 6222 7909 or book a meeting now via his booking page.

Footnotes