Many years ago, I came across a model that outlined the various career paths and tax system structures that exist in most countries, but in its simplest format. It was called The Cashflow Quadrant and was in a book by the same name authored by Robert Kiyosaki.

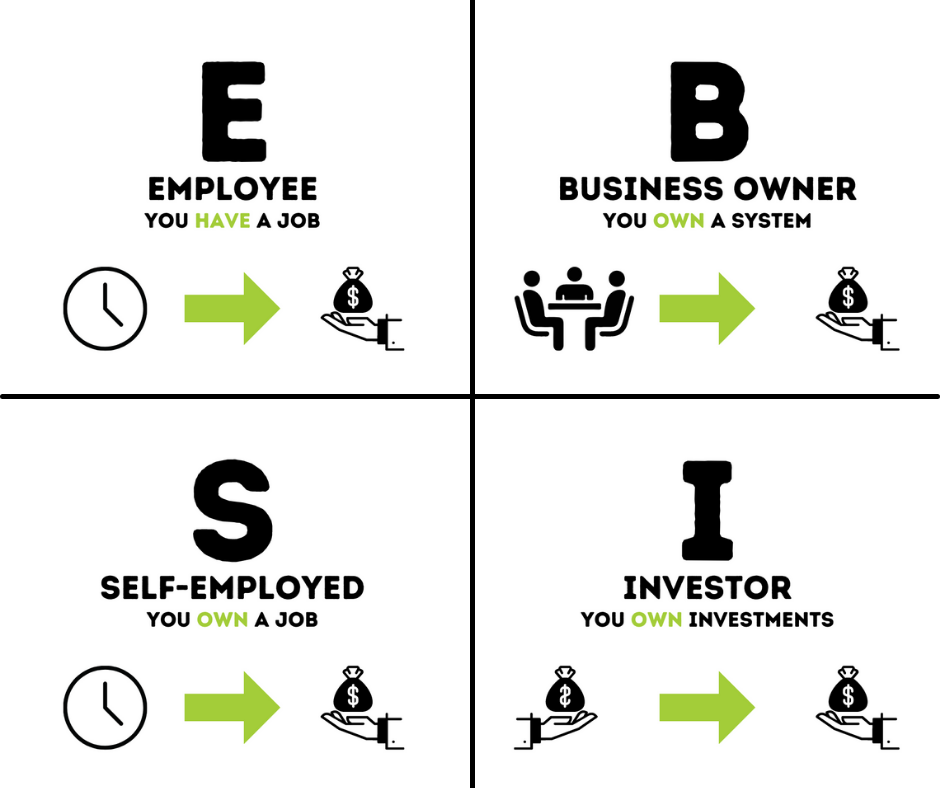

Essentially it is a table divided into four areas:

Idealistically you can be in all four quadrants, but it is very important to understand that most people are only in one or at best two.

Furthermore, the left-hand side of the table is what they call “Active” income meaning you are trading your time for money so therefore in order to make money you must do something. The right-hand side is “Passive” income which essentially means that you do not need to be present to generate income. Things like real estate, shares (or stocks), and bonds are all passive sources of income….you literally make money whilst sleeping!

When it comes to the taxes we pay, usually the left-hand side of the table pays higher (or more) taxes than the right-hand side. This wasn’t always the case with small businesses being what most countries were built on. Sadly, the self-employed are constantly getting hit with new costs & taxes that larger businesses can either avoid or minimise through various legal tax loopholes or waivers. Small business owners don’t have lobbyists, a team of lawyers, and accountants to minimize taxes and regulations. Rightly or wrongly, our tax system is designed to favor large businesses (B) and investors (I). Typically in these quadrants, you get lower tax rates.

Love him or hate him, if you were to take on and understand only one of Robert Kiyosaki’s ideas, this would be it.

Want to learn more about how the tax system works and how you can use it to save yourself some money come tax time?

Written by Conrad Francis, Founder & Director of Inspired Money & www.conradfrancis.com