When it comes to ultra-high net worth individuals (UHNWIs), also known as the super-rich, their investment choices are a topic of fascination and intrigue. The latest Frank Knight Wealth Report sheds light on where these individuals, with a net worth of at least $US30 million ($A45 million), choose to invest their substantial wealth. In this blog post, we will delve into the report’s findings, exploring the impact of inflation, the conflict in Ukraine, and rising interest rates on the wealth of UHNWIs. We will also uncover their preferred asset classes and highlight the dramatic role that commercial property plays in their investment portfolios.

The Wealth Impact

According to the Frank Knight Wealth Report, the year 2022 witnessed a significant decline in the total wealth held by UHNWIs. A combination of factors, including inflation, the conflict in Ukraine, and rising interest rates, caused their wealth to shrink by a staggering 10%, equivalent to a drop of $US10 trillion. While this decline may seem substantial, it is essential to maintain perspective, as these individuals still maintain an impressive level of affluence.

Preferred Asset Allocation

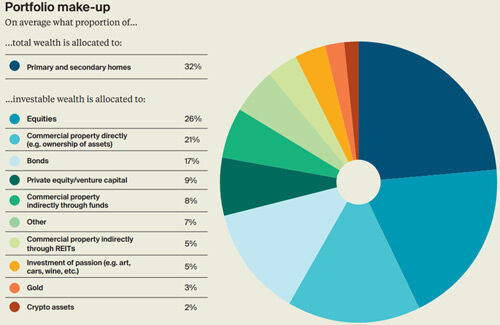

When it comes to their preferred choice of assets, the super-rich exhibits a distinctive investment pattern. Surprisingly, their primary investment is not just in financial instruments but in real estate as well. On average, UHNWIs have approximately 32% of their wealth tied up in their homes, emphasizing the plural nature of their property holdings. Following homes, shares constitute the second most significant portion of their investment portfolio, accounting for approximately 26% of their wealth allocation.

The Role of Commercial Property

One of the most intriguing findings from the report is the significant role played by commercial property in the investment portfolios of UHNWIs. The super-rich allocates a substantial portion of their wealth to commercial property, making it a prominent asset class for them. Directly held commercial property represents 21% of their wealth allocation, while investments in property funds and real estate trusts account for 8% and 5%, respectively. Collectively, commercial property can contribute up to 34% of the ultra-rich’s wealth allocation, making it a vital component of their investment strategy.

The latest Frank Knight Wealth Report offers valuable insights into the investment habits of UHNWIs, shedding light on where the super-rich choose to allocate their substantial wealth. Despite facing challenges such as inflation, geopolitical conflicts, and fluctuating interest rates, these individuals continue to maintain a significant net worth. Their preferred asset classes highlight their inclination towards diversification, with homes and shares dominating their investment portfolios. However, the unexpected prominence of commercial property as an asset class for the super-rich unveils a fascinating dimension of their investment strategy. By analyzing these trends, investors and industry professionals can gain valuable insights into the choices and preferences of UHNWIs.

For more information on the topic, you can contact one of the Inspired Money Team to discuss how you may benefit from reviewing your current investment asset allocation.

Remember, this article provides general information and should not be considered personalised financial advice. If you have specific questions or concerns, it is always recommended to seek guidance from a professional financial advisor or accountant.

This article was written by Director & Senior Adviser Shane Mitchell. To book a session to review your investments and asset allocation contact Shane directly on 08 6222 7909 or book a meeting directly via his booking page.