This article was originally published by Shane Mitchell on LinkedIn on the 1st of November 2022

We hear it splashed around throughout the media but what exactly is this thing called mortgage stress?

Whilst it’s difficult to find a technical definition of what it takes financially to be under mortgage stress, the finance industry’s general consensus is that you are suffering mortgage stress when you are spending greater than 30% of your pre-tax income on home loan repayments.

The challenge with this is that in most modern world countries, the interest component of home loan repayments is not tax deductible so we only have post-tax income utilised when making mortgage repayments. Thus, anyone earning $100,000 of taxable income and in mortgage stress (using the finance industry’s definition) is actually using 40% of their available income from employment to make their repayments.

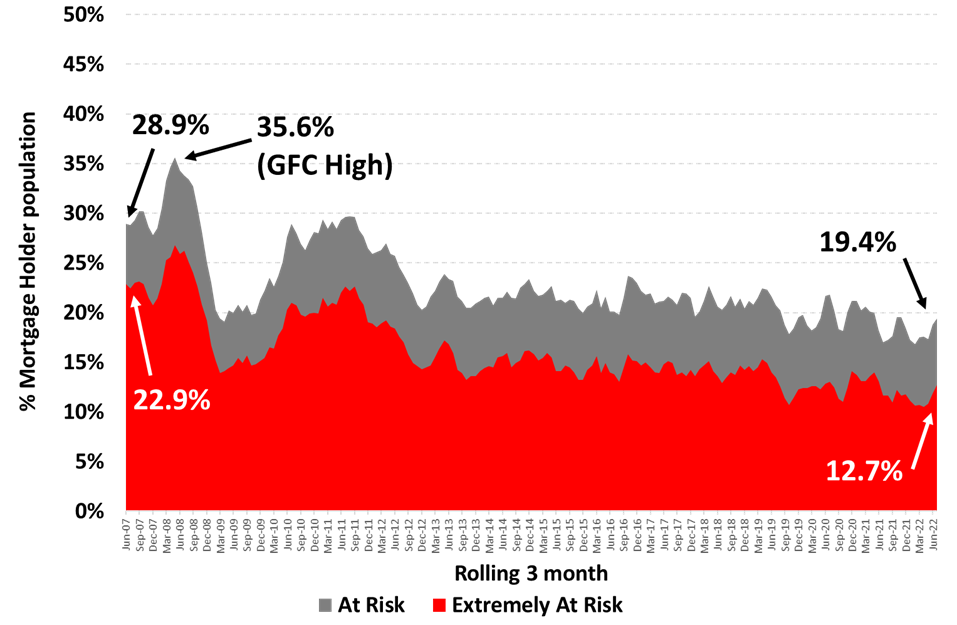

Source: Roy Morgan

Why is mortgage stress such an issue now?

As per the chart above, Mortgage stress in Australia was significantly higher back in 2008, coincidentally the last timeshare markets globally experienced a prolonged bear market and it was deemed that rising interest rates was the way to quell the public’s spending. But, back in ’08 home loan interest rates were already sitting above 7% with threats of going above 10% as compared to the current rate rise cycle which saw rates teetering as low as 2.41% in April 2022 thanks to the RBA reducing their cash rate target down to 0.1% in November 2020.

The access to cheap money for the last couple of years has created a frenzy, one which saw house prices increase once covid19 lockdowns in Victoria and New South Wales were over and flush with cash following a decrease in spending during a time that saw the national savings rate climb from 6% to 19%. Purchases of new homes (Aussies’ seemingly favourite purchase) and along with it, a decent increase in the amount of personal debt held by Aussie investors and first homebuyers.

This time is different from the ’08 interest rate cycle as for the first time in a very long time, the global economy is battling its own war with inflation. Steep increases in home loan repayments coupled with sharper-than-normal increases in the standard cost of living are biting much harder for households who have come off the back of a handful of years of cheap money and rising asset prices. Australians are being challenged to make choices with respect to how they spend their incomes. How they respond is critical to getting through this phase of the economic cycle. One was normally seen with large employment lay-offs as the economy looks to get spending under control.

It wouldn’t be the worst time to build a healthy cash reserve, either in a mortgage offset/redraw account or even high-interest savings accounts with the banks now that they are offering more attractive returns than has been seen in recent years. Also, a great time to just check the household budget for any obvious areas of wastage. It’s so easy to let savings easily leak out of your accounts because you haven’t spent the time to run a simple audit on your must-haves versus your like-to-haves.

If you’re starting to feel the heat from the last seven interest rate hikes or are wanting to investigate whether your bank is still best for you then please reach out to me or one of the Inspired Money Team on 08 6222 7909 or email us at admin@inspiredmoney.com.au.