Across Australia, a significant housing trend is emerging in the housing market that mirrors a similar pattern observed in the United States: baby boomers are choosing not to downsize or sell their large family homes. This decision by the older generation is impacting the availability of housing for younger Australians and shaping the real estate landscape in notable ways.

Low Housing Inventory and High Prices

Just as in the U.S., Australia is grappling with a low inventory of available homes, which is pushing property prices higher. Older Australians are holding onto their properties, partly due to emotional attachments and partly because of the advantageous financial security these assets offer. This reluctance to sell is exacerbating the housing shortage, making it harder for younger generations to find affordable homes.

Tax Considerations and Financial Incentives

One of the key reasons for this trend is related to financial incentives, particularly concerning capital gains tax. In Australia, the family home is exempt from capital gains tax if it’s been the owner’s primary residence throughout the ownership period. This exemption makes it financially advantageous for older Australians to hold onto their homes rather than selling and facing potential tax implications on a new purchase or investment.

The Sentimental Value of Home

There’s also a strong emotional component to the decision to stay put. Many baby boomers have spent decades in their homes, raising families and building memories. The prospect of leaving a much-loved family home for a smaller, unfamiliar space can be daunting. Additionally, these homes often provide the space for hobbies, hosting family gatherings, and maintaining a preferred lifestyle, factors that aren’t easily given up.

Lack of Suitable Alternatives

The Australian market, much like its American counterpart, often lacks appealing downsizing options. Older adults looking to downsize face challenges finding homes that meet their needs in terms of size, accessibility, and location. Many downsizing options available on the market do not match the comfort or utility of their current homes, discouraging a move.

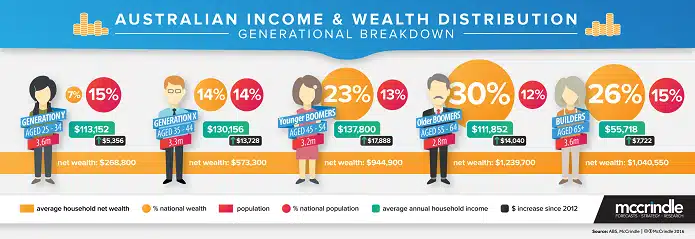

This infographic by McCrindle is based on an analysis of the ABS Household Income and Wealth data released in late 2015 and 2013. It gives a picture of how both income and wealth is distributed across the generations of households in Australia and how it has been changing.

Economic Impact and Future Outlook

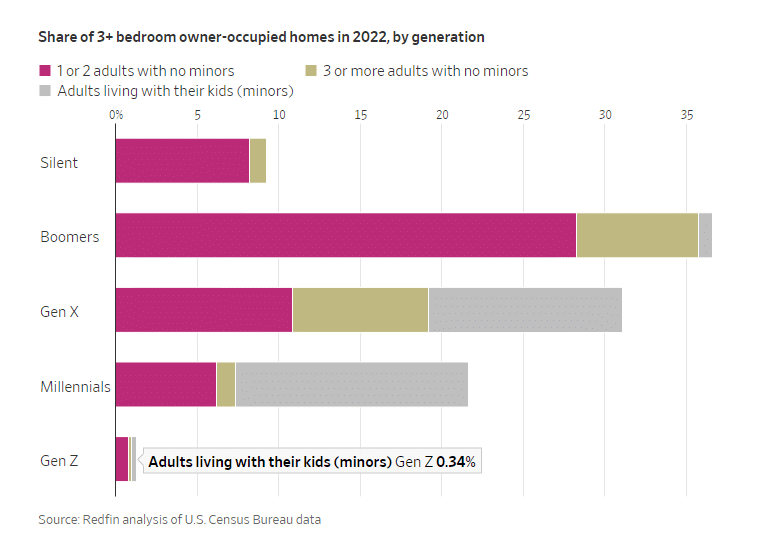

These types of housing trends have broader economic implications. It affects property market dynamics, influences urban development, and impacts the financial decisions of families across multiple generations. As discussed in a Wall Street Journal article on U.S. housing trends, where boomers are also holding onto their homes, this phenomenon is creating a squeeze on the housing supply that affects everyone (“Boomers Bought Up the Big Homes. Now They’re Not Budging.” – WSJ).

As the population ages and more baby boomers reach retirement age, it remains to be seen how this trend will evolve. Will the next generation face even greater challenges, or will market changes prompt a shift in these trends?

Australia’s housing market is at a crossroads, and the decisions made by today’s older homeowners will shape the landscape for decades to come. It’s a pivotal moment for real estate, policymakers, and families across the nation.

If this article has raised any queries or concerns then why not reach out to one of the Inspired Money team who are well equipped and happy to meet and discuss this with you, you can reach the team on 08 6222 7909 or admin@inspiredmoney.com.au.