For many, retirement should be a fantastic time of life, the culmination of a life lived working and time spent earning a regular income, some of which is spent and some of it saved. So why then is it so difficult for many retirees to have the kind of lifestyle they dreamt of?

Partly because many of us are not that great at saving for later, even when we know we should be doing more. Many of us continue to live pay check to pay check leading to us not having the greatest relationship with money.

The rise of superannuation has provided us with the opportunity to save, tax effectively, for retirement, and rising house values have seen the values of inheritances significantly increase over the past 15 years.

So if our wealth is increasing as we age, why then do our current retirees find it difficult to live a more expansive lifestyle?

What are the perceived risks in retirement?

Risk could be defined as the permanent loss of capital, volatility, uncertainty, drawdowns, underperforming a benchmark, missing out on opportunities, making a big mistake at the wrong time, not knowing what you’re doing and more.

For most normal people the most realistic risk is not achieving your goals.

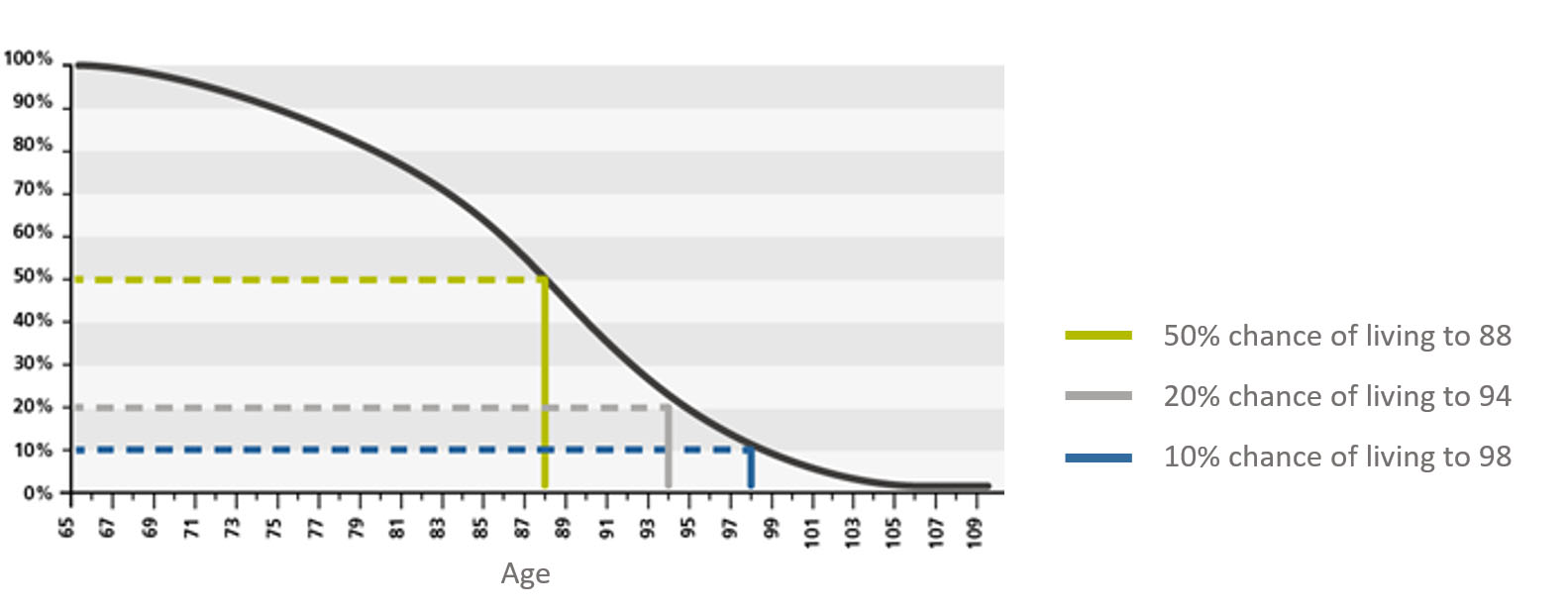

But the true risk for many people is longevity — the risk that you run out of money before you die. This is the biggest risk in retirement for the majority of the population.

When you consider how ill-prepared most Australians are when it comes to retirement savings, it’s surprising more people don’t blow through their entire nest egg when they stop working.

In fact, the opposite is the problem for many people — they don’t spend enough in retirement.

An American study into the spending habits of retirees during the first 2 decades of retirement found the following:

- People with less than $200k in assets (not including their house) spent around 25% of their savings in the first 18 years of retirement.

- Individuals with between $200k and $500k heading into retirement spent a little more than 27% of their money.

- Retirees with $500k or more at retirement spent less than 12% of their nest egg within the first 20 years of retirement (on a median basis).

- People with a pension spent the least from their portfolio with assets down an average of just 4% (versus a 34% decline for non-pensioners).

- The median household in this study simply spent the income from their portfolio and avoided taking from the principal portfolio balance.

These were median numbers so there were obviously some people who did spend most or all of their savings but one-third of retirees were found to have even more money than they started with.

This seems counterintuitive but makes sense if you’re earning higher returns than your withdrawal rate.

One conclusion we can draw from these studies is many retirees simply can’t force themselves to spend down their portfolios, even those with the financial wherewithal to do so. In fact, the American study showed the group with the highest level of assets had the lowest spending rates.

Written by Director & Senior Adviser Shane Mitchell.

To book a session to review your retirement goals contact Shane directly on 08 6222 7909 or book a meeting directly via his booking page.